Which of the Following Intangible Assets Is Not Amortized

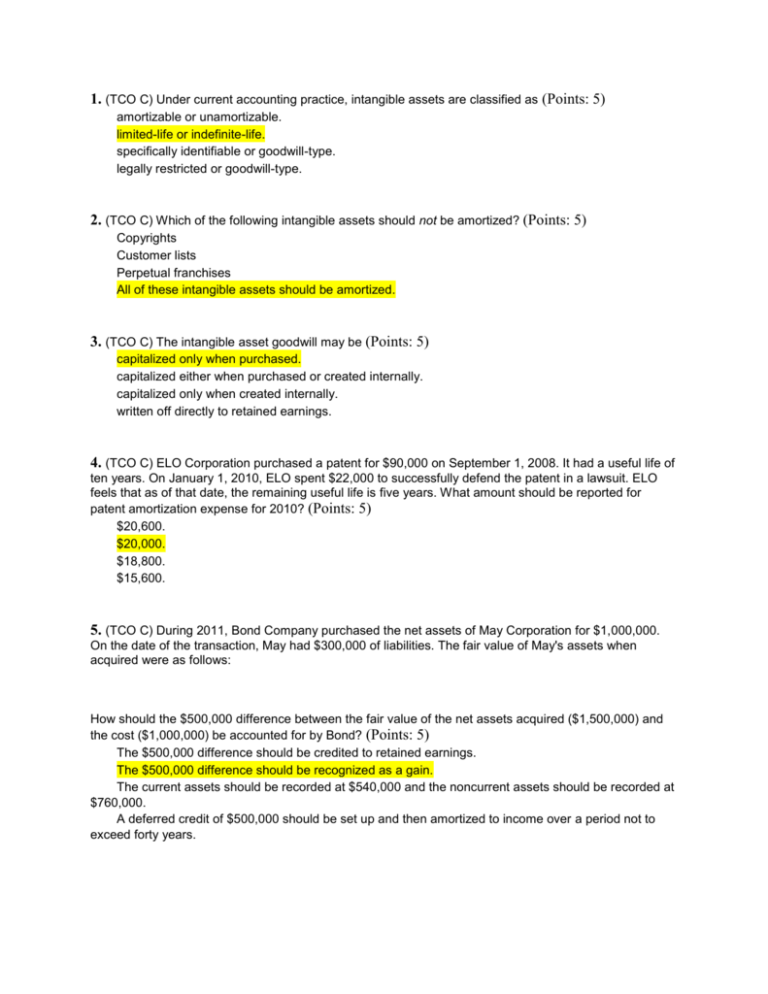

All intangible assets must be amortized. C Intangible assets with indefinite useful lives will be not be amortized________.

What Are Intangible Assets Double Entry Bookkeeping

Which of the following intangible assets is not amortized.

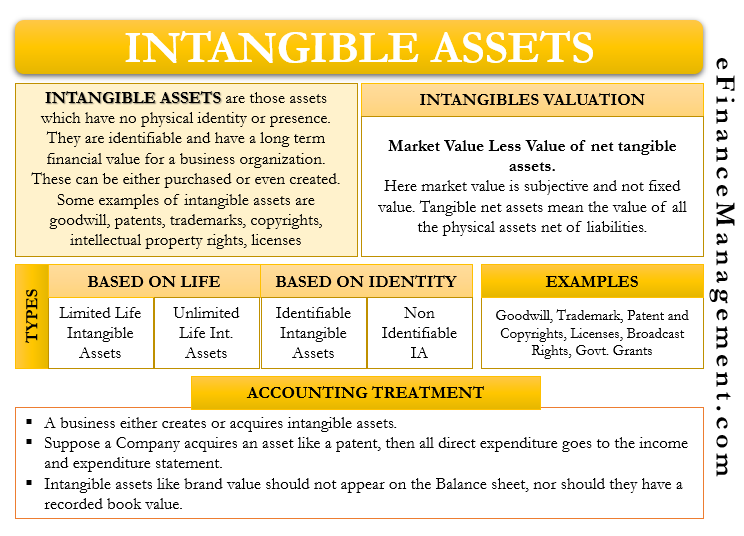

. Amortization applies to intangible non-physical assets. Annual review for impairment C. Intangible assets other than goodwill may or may not be amortized depending on their useful lives to the entity.

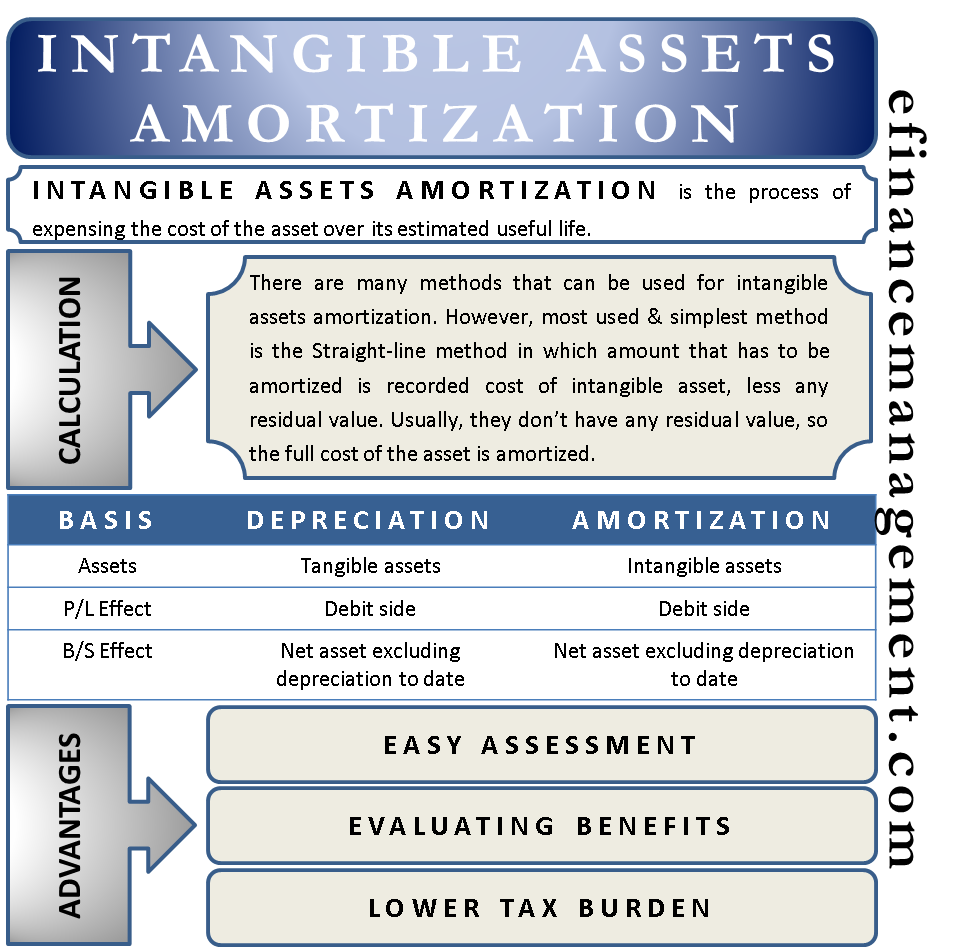

There is no arbitrary ceiling on the useful life of an amortized asset. The amortization of an asset should only start when the asset is brought into actual use and not before even if the requisite intangible asset has been acquired. Solved Which Intangible Assets Are Amortized Over Their.

Which of the following intangible assets should not be amortized. This occurs until the end of the intangible assets useful life. Generally Accepted Accounting Principles the cost of this research and development must be.

Finite intangible assets are typically amortized using the straight-line method over the useful life of the asset. 7Trademarks newspaper mastheads and internet domain names are all examples of a. The level of amortization should be appropriate so that the book value of an asset is not under or overstated.

Perpetual franchises should not be amortized because it has an indefinite life and indefinite life intangibles are tested for impairment loss on an annual basis. A franchise trademark or trade name. Factors considered in determining an intangible assets useful life include all of the following except a.

The total amount assigned and the amount assigned to any major intangible asset class. For intangible assets subject to amortization all of the following. Goodwill is an intangible asset that is not amortized but is instead tested for impairment on an annual basis.

Assets with indefinite lives are not. D expensed as incurred. For intangible assets used in the manufacture of a product amortization is a product cost and is included in the cost of inventory.

Which of the following intangible assets is not amortized. The economic or useful life of an intangible asset is based on an estimate made by management and is subject to change under certain market conditions. Goodwill is not amortized.

The cost of an intangible asset with a definite useful life is allocated to expense using the straight-line method and is called amortization. The weighted-average amortization period in total and by major intangible asset class. Which of the following methods is commonly used to amortize intangible assets over their useful lives.

Marketing-related intangible assets d. FigureThe amortization process is like. As per the IFRS and US GAAP goodwill is not amortized as it is usually infinite.

Answered May 14 2016 by dnsmith. Intangible assets with an indefinite life should not be amortized. In January 2021 Vega Corporation purchased a patent at a cost of 200000.

Section 197 of the IRS tax code lists and defines the following assets as intangibles with an indefinite life assuming you created the assets as a substantial part of buying the business. Assets with finite lives are amortized. The amount of any significant residual value in total and by major intangible asset class.

This is the best answer based on feedback and ratings. ExplanationGoodwill refers to the intangible asset that arises when one company purchase another for a value higher than its tangible and intangible assets. Goodwill the difference between the purchase price of a business and the business total asset value 4.

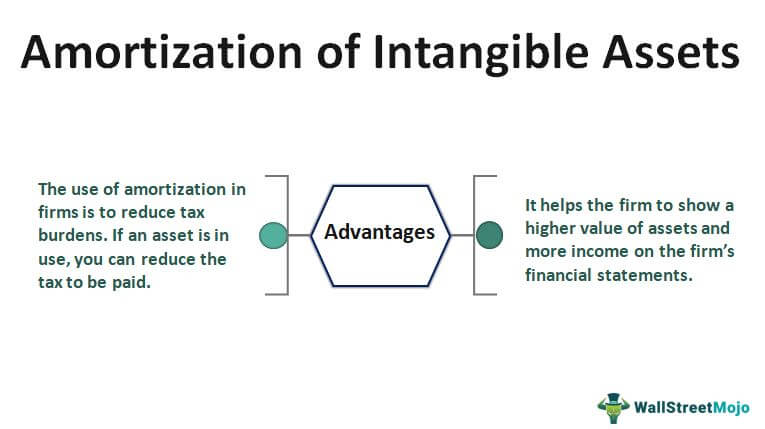

The correct answer is Customer lists. An intangible assets annual amortization expense reduces its value on the balance sheet which reduces the amount of total assets in the assets section of the balance sheet. An intangible asset is recorded at the cost incurred to purchase it.

FALSE More questions like this. B Intangible assets include patents copyrights and natural resources________. Home Bookkeeping Solved Which Intangible Assets Are Amortized Over Their.

Which intangible asset should not be amortized. B recorded as an intangible asset and amortized over 20 years. Contract-related intangible assets b.

C recorded as an intangible asset and tested for impairment on a yearly basis. IAS 38 provides general guidelines as to how intangible assets should be amortized. Artistic-related intangible assets c.

Legal and filing fees of 50000 were paid to acquire the patent. Indicate whether the statement is true or false. Intangible assets with an indefinite.

These intangibles can only be amortized under Section 197 if you created them as a substantial part of buying the assets of a business. Intangible assets such as patents and trademarks are amortized into an expense account called amortization. The expected use of the asset.

D The cost of land should be depleted over its useful life________. Any provisions for renewal or extension. A recorded as an intangible asset and not amortized.

Goodwill is an intangible asset that is not amortized but is instead tested for impairment on an annual basis. The economic or useful life of an intangible asset is based on an estimate made by. View the full answer.

E The cost of a natural resource should be expensed depleted over its useful life. Any legal or contractual provisions that may limit the useful life. Amortization of intangible assets is a process by which the cost of such an asset is incrementally expensed or written off over time.

Up to 24 cash back This is similar to depreciation but is credited to the intangible asset rather than to a contra account. None of these methods are correct since intangible assets are not amortized. Asked May 14 2016 in Business by Aurora.

Intangible assets with an indefinite life are not amortized but are assessed yearly for impairment.

1 Tco C Under Current Accounting Practice Intangible Assets Are

Intangible Assets Amortization All You Need To Know Efm

Amortization Of Intangible Assets Financiopedia

Intangible Assets Financial Accounting

What Are Intangible Assets A Beginner S Guide

12 1 Actg 6580 Chapter 12 Intangible Assets Lo 1 Characteristics 1 Identifiable 2 Lack Physical Existence 3 Not Monetary Assets Normally Classified Ppt Download

Amortization Of Intangible Assets Definition Examples

How Do Intangible Assets Show On A Balance Sheet

Intangible Assets Meaning Valuation Categories Example Accounting

Amortization Of Certain Intangible Assets

How Do Intangible Assets Show On A Balance Sheet

History Of Intangible Assets Annual Reporting

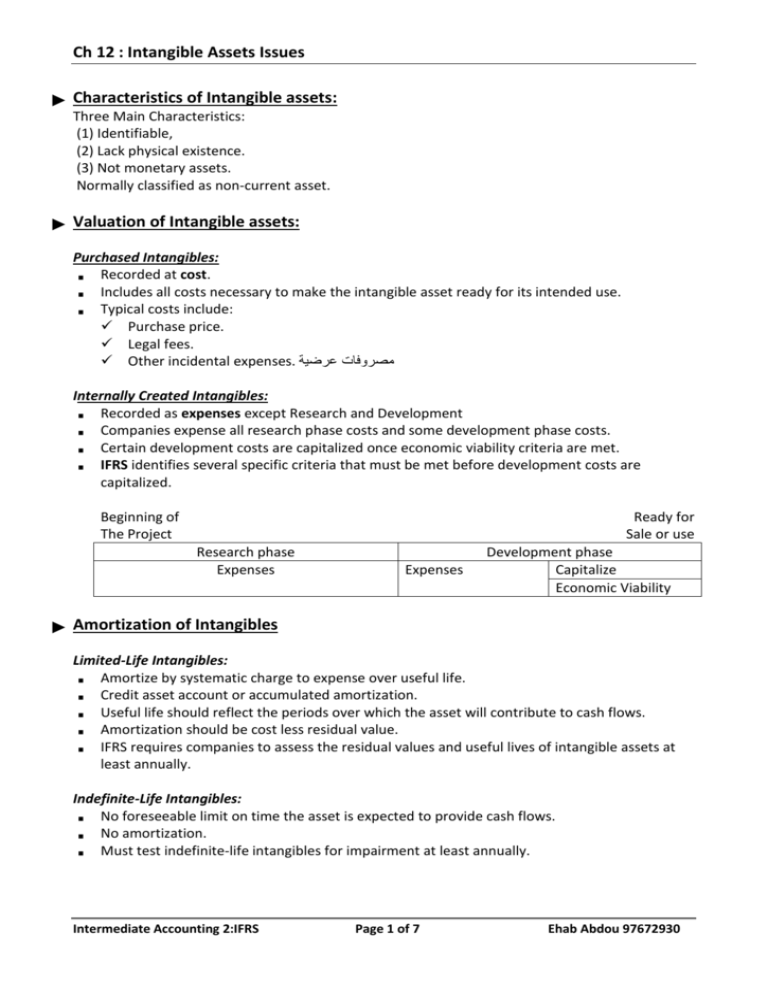

Ch 12 Intangible Assets Issues Characteristics Of Intangible Assets

How Do Intangible Assets Show On A Balance Sheet

Amortization Of Intangible Assets Formula And Excel Calculator

Amortization Of Certain Intangible Assets

Amortization Of Intangible Assets Formula And Excel Calculator

Comments

Post a Comment